COVID-19 Has Made Pricing Car Insurance Even More Difficult

Cambridge Mobile Telematics (CMT) and J.D. Power recently shared data on consumer sentiments and behavior in a series of reports and webinars. The mix of surveys and telematics-based driving insights painted a precise picture of the impact of COVID-19 on the insurance market from a demand standpoint. From March onward, J.D. Power ran “Pulse Surveys” every week. They showed the U.S. population went through three phases: the initial shock, near panic in mid-April, then realization and the beginning of anticipation of their mobility needs. As we approach some new normal, this data informs us of the difficulties to come in correctly assessing driving risks.

Changes in Traffic Patterns

First, the insurance sector has been pushed to reduce premiums across the board, even though driving has clearly not changed at the same level everywhere. CMT’s telematics data shows that traffic volumes in western states like Idaho, Wyoming, North Dakota or Montana decreased by only 25 to 30% at the peak of the lockdown. At the same time, places like New York City, Detroit or Boston all went down 50% and cities like Houston or Chicago showed a 60% fall.

Post lockdown, reopenings have not had a dramatic or cohesive effect on the change in mobility. For example, the U.S. may be back at 75% of pre-COVID-19 traffic volume nationwide; but from a rush hour standpoint, it has not returned to the same levels. Clearly driving patterns have changed which suggests the reason for driving and the type of trips have changed.

Additionally, crash frequency is down along with the average decrease in mileage. Severity of crashes, however, is markedly up. Not necessarily the claims dollar amounts, but the actual physics involved in the crash are more severe. This is not a new trend – in-car safety technology evolution fostered that years ago, but something the industry should expect to see for the foreseeable future as it is not going to wane.

Speed and distraction have been factors of increased risk seen throughout the U.S. In fact, we have seen smartphone distraction peak throughout this entire period. The peak of speeding occurred in early April, which corresponded with the absolute lowest number of cars on the road.

With lockdowns easing, the traffic in various counties is changing at very different paces depending on geographies. The real issue is that smartphone distraction has not really abated at all. Now the challenge comes down to how that behavior translates into a period of time when road density increases again.

Increase in Consumer Demand for Telematics

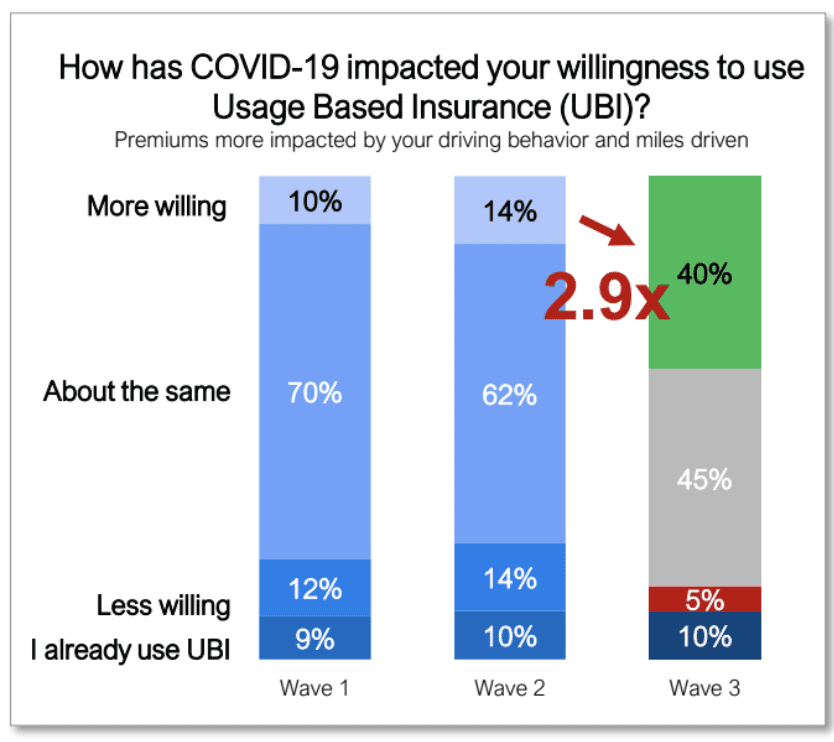

Both webinar presenters anticipated customers are now actively shopping for lower priced insurance. According to J.D. Power, 55% of consumers believe they will drive less after social restrictions are lifted. The surge in price sensitivity has come together with a boost in consumer interest for telematics. The Pulse Survey suggests consumers are 2.7 times more interested in telematics over the last five weeks. Only insurers with an existing UBI strategy have been able to take advantage of the increased interest, retain their customers, and potentially acquire new ones.

Going forward, analyzing what predicts crashes or what behaviors lead to crashes is clearly not going to be the same post-COVID-19. Predicting crash risk based on the usual social and economic proxies from the last six months will become unreliable and noncompetitive.

Traditional rating factors are now demonstrably less reliable for loss prediction and are ill-equipped to assess new risks for the purposes of loss prediction. Without telematics, insurers will struggle to show their discerning customers that they can match rate to risk. Aggregate data indicates overall safer driving patterns that do not reflect how any individual person is driving.

CMT was able to monitor how the nature of motor risk and what policyholders need from insurers have changed as a result of COVID-19. From the beginning, insurers using CMT’s DriveWell platform were much better prepared to respond to new consumer expectations.

Telematics enables responsive and valued offerings with pricing based on an individual’s risk as opposed to aggregate changes. Insurers can also use telematics to positively reinforce safe behaviors, which is as valuable as ever during and after the lockdowns.

The data from mobile telematics responds to driver needs today, and waiting for complex OEM data platform arrangements will not help. Risk predictive information is needed now, and it needs to be controlled by the insurers and usable immediately. If the COVID-19 crisis has shown anything, it is that the lack of granular data has made it impossible for insurers to make sound decisions. This is in parallel with the health authorities that would be unable to make decisions with the right data on COVID-19.

When you work with CMT, you are always prepared to adjust to new risk on mobility. Contact us to get started!