The Benefits of “Letting your Insurer Ride Shotgun”

CMT Partners spotlighted in the New York Times

Recently, CMT’s partners State Farm, Liberty Mutual, and Nationwide were featured in The New York Times, testifying how their smartphone telematics programs are saving their policyholders money. We are thrilled to see so many of the leading companies who use CMT’s DriveWell technology in their apps referenced and quoted, highlighting their leadership in bringing more equitable usage-based insurance options to their policyholders and helping improve their drivers.

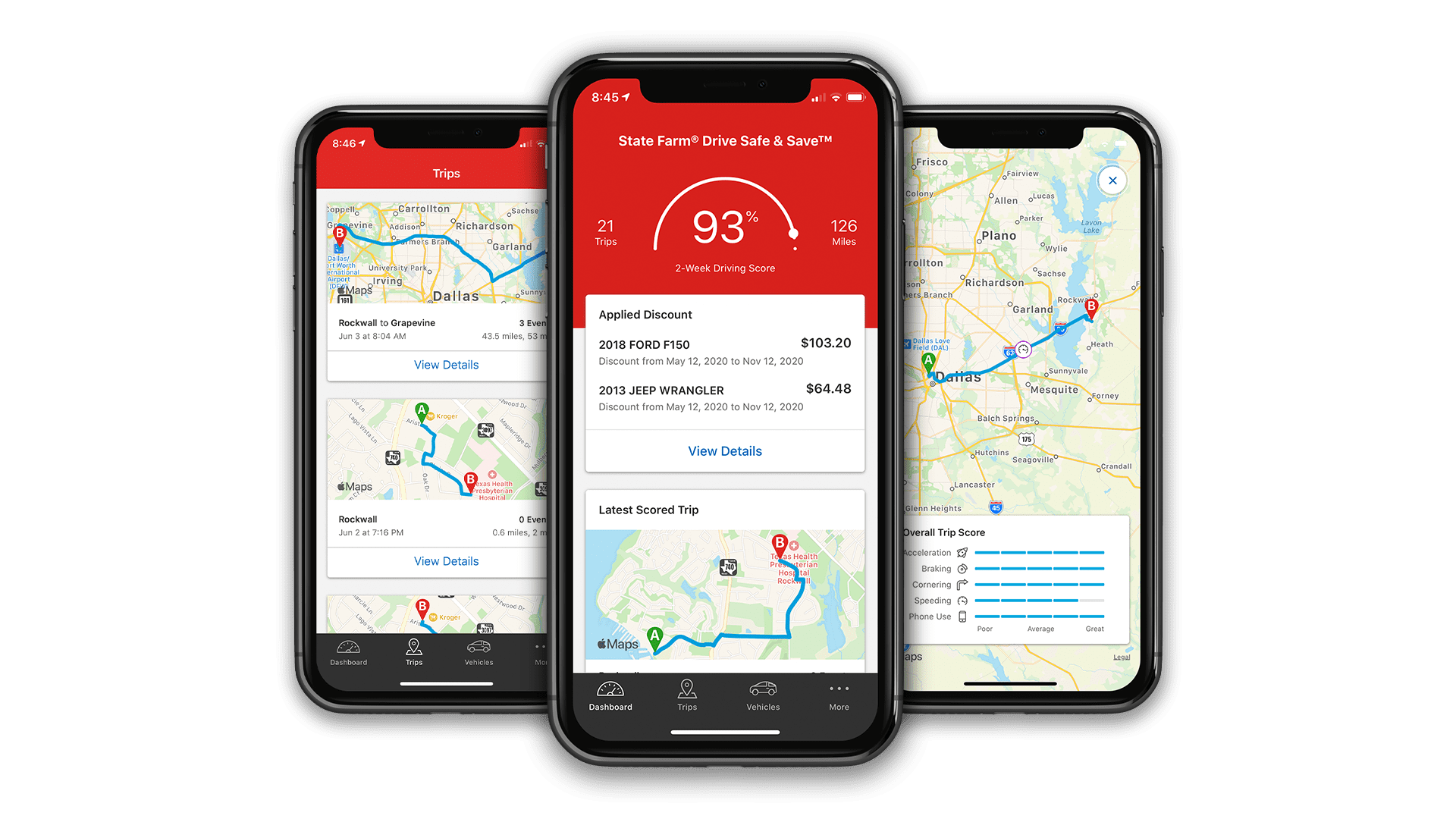

Their safe driving apps, powered by CMT, capture risky driving behaviors like excessive speeding, hard braking, and sometimes even phone-based distraction. The data is first and foremost used to give feedback to the driver. The aim of the programs are to engage drivers in becoming safer, not to spy on them. With this information, insurers can offer their customers fairer policies based on their actual driving performance.

“The average discount [a driver receives] is between 10 and 15 percent, but we regularly see customers receiving 20 to 30 percent discounts. The maximum is 50 percent.” – Scott Bruns, Director of Telematics Services, State Farm

The article states that approximately 10 to 20 percent of policyholders have opted into telematics programs, however, a recent consumer survey conducted by CMT indicates that these numbers could be much higher with more awareness and availability of such programs. As the pandemic and its effects continue to spread, J.D. Power has found that the consumer sentiment around telematics programs and demand increases week over week.

Usage-based insurance via smartphone telematics isn’t meant to penalize drivers for occasional risky driving events. Instead, it enables policyholders to improve and develop safer driving habits, leading to savings. In turn, policyholders have more control over the cost of their auto insurance, and that’s something that should be written about in outlets like the New York Times and celebrated by the insurance companies who run these programs.