The power of digital engagement for automakers

In 2018, Bank of America launched an AI-driven virtual assistant called ‘Erica’ in its mobile app. The goal was to bring a more personalized experience to its customers. Since its launch, ‘Erica’ has significantly boosted Bank of America’s digital engagement and revenue. The company reports that 27% of customers engage with Erica monthly. Since its launch, Erica has seen 1.5 billion customer interactions.

As a result, Bank of America saw engagement jump 35% from 2022 to 2023, leading to this 2023 headline in Fortune: “How ‘Erica’ helped power a 19% spike in earnings at Bank of America.” The 19% increase in earnings resulted in $7.41B in revenue in Q2 2023. In 2023, Bank of America ranked #1 in JD Power’s annual study for customer satisfaction — because of app innovations like ‘Erica.’

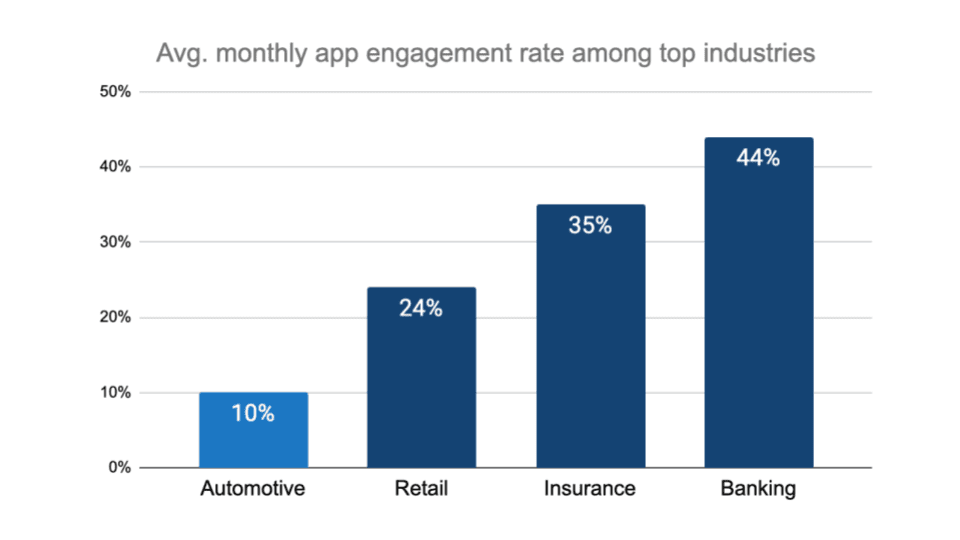

Bank of America’s ‘Erica’ is just one of many examples of how top consumer brands enhance customer experiences, loyalty, and revenue through new customer engagement strategies. Leading companies in consumer markets, like retail and auto insurance, have focused on similar strategies to boost mobile app engagement. CMT’s research shows that 24% to 44% of customers use these apps monthly across the industries.

Following this trend, automakers have created valuable personalized app experiences for their customers for over a decade. However, automakers only see 10% of consumers engaging with their brand’s app each month, trailing behind retail, insurance, and banking sectors.

Why is this?

One reason is that automakers’ MyBrand apps offer convenient vehicle, safety, and security features that cater primarily to people who own connected vehicles, or connected customers. MyBrand apps provide little incentive for people who own unconnected vehicles, or unconnected customers, to download and use their automaker’s app. In fact, many MyBrand apps ask customers to enter their VIN, blocking unconnected customers from using the app.

Today, only 20% of cars on the road have an active embedded telematics unit and are considered “connected.” As a result, automakers are missing an opportunity to engage with the 80% of their customers who can’t use their apps today.

Automakers are investing in other ways of reaching these customers. Multiple automakers invested $7 million for 30 seconds of airtime to reach the Super Bowl’s 123 million viewers this year. Automakers also hold seven of the top 10 spots for spending the most on local TV ads. While TV advertising is good for building broad brand awareness, it doesn’t have the same ability to drive brand engagement with customers and create personalized experiences.

As we saw with Bank of America’s investment in ‘Erica,’ personalized experiences are critical for B2C companies. For over 65% of consumers, personalized experiences result in higher brand loyalty. Loyal customers are 5X more likely to purchase from the same company again. Plus, they become advocates — over 50% of the most loyal customers recommend their preferred brands to others.

For automakers, word-of-mouth recommendations influence car-buying decisions the most, impacting 50% of buyers. Loyal customers are also less price-sensitive and spend 43% more money with the brands they love.

Winning brand loyalty is more critical for automakers than ever today. In 2022, automakers saw an eight-year low in brand loyalty due to chip and inventory shortages. Today, only 34% of customers with cars 12 years or older say they would buy from the same brand again. This could be because automotive customers aren’t feeling the love — 55% of customers don’t think their automaker cares if they change brands when they buy their next vehicle.

Brand engagement has become more important as well for automakers. Automakers have recently shifted their strategy from driving revenue almost entirely from manufacturing to include revenue from software services. Today, they’re waiting for 80% of their customers — the unconnected — to convert to connected vehicles to unlock these software-based revenue opportunities. But vehicle owners typically purchase new vehicles once every 12 years. With billions of dollars at stake, waiting is a risky bet.

Bank of America saw critical loyalty gains as it launched ‘Erica’ and increased app engagement. CMT’s research shows that automakers benefit from app engagement as well. We’ve found that over 50% of customers who are app users are loyal to their brand and plan to purchase from their automaker again. Our research also shows that 68% of customers with their automaker’s app service their vehicles at certified repair centers for routine maintenance or after a crash, increasing their customer lifetime value. Sixty-one percent of customers who visit certified service centers for vehicle maintenance say they’ll buy from the same brand again. Automakers’ research shows similar results.

We’ve seen how personalized experiences can drive engagement and how important engagement is for building brand loyalty and driving revenue. Certain automakers have realized this and are expanding their connected car strategy to focus on connecting their unconnected customers.

Their first challenge is to figure out what their must-have digital experiences are. How can they get unconnected customers to download an app and return to it again and again? To recreate some of the features that connected vehicles deliver, leading automakers are turning to telematics programs to build in-app features that drive adoption and engagement.

Telematics-powered safety and rewards programs, where drivers learn about their behaviors, get personalized coaching, and specialized rewards like maintenance discounts have proven that they can keep customers engaged over time. They can also help drivers find more affordable auto insurance.

Life-saving crash detection and emergency response is also a popular program among consumers — 50% of consumers say they’d download their automaker’s app to get it. It also accelerates the repair process.

Just like Bank of America and ‘Erica,’ app adoption and engagement represent a huge opportunity for automakers. Two out of three drivers with a car over 12 years old plan to change brands with their next purchase. Increasing app adoption and engagement could create more loyal customers, increase repeat purchases, and generate new revenue in vehicle sales as well as parts and services areas.