CMT Releases New Report on U.S. Connected Insurance Propositions

Download "US Drivers' Appetite for New Connected Insurance Propositions" Now

Cambridge Mobile Telematics’ latest report, “US drivers’ appetite for new connected insurance propositions,” details U.S. drivers’ changing needs over the past year. The report is the second installment of the series From Crisis to Opportunity: Charting Insurance Innovation in 2021, based on two surveys given to 3,000 insured U.S. drivers.

Key Findings

Since the pandemic, interest in switching to UBI has increased significantly – by as much as 63%. Rewards for safe driving are highly favored among the value-added services as well as automatic roadside assistance. A trend that CMT continues to see in its data is that drivers are very open to paying for safety as a service.

Evolution of the Telematics Insurance Value Propositions

CMT surveyed U.S. drivers on four value propositions: Distance-Based insurance, Behavior-Based Insurance, Behavior-Based Insurance with cash back, and Rewards-Based Insurance. The data concluded that pre-pandemic U.S. drivers significantly favored behavior-based insurance with or without cash back, but post-pandemic drivers’ interest in distance-based auto insurance increased significantly.

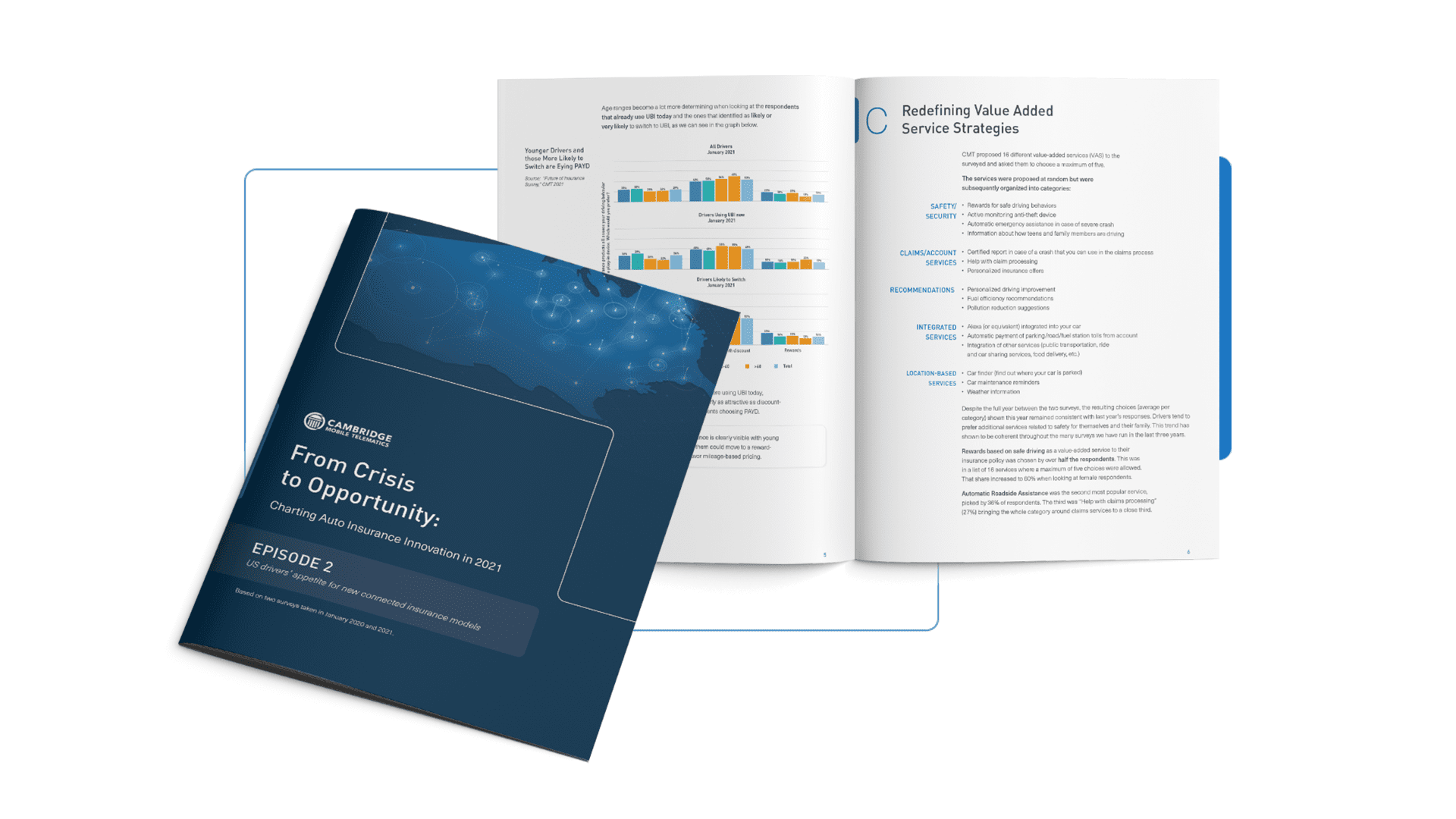

Redefining Value Added Service Strategies

Additionally, CMT provided sixteen different Value-Added Services (VAS) and asked the participants to select a maximum of five that were important to them. Among safely-related services, rewards given based on safe driving, automatic roadside assistance, and location based services all ranked highly.

Identifying Current UBI Subscribers

Four years of research has shown that many drivers are misinformed about whether or not they are using UBI. CMT found that many U.S. drivers think they are using such a policy when they are actually using traditional insurance products. This dilemma is something agents should be aware of so they can inform insurers on the difference between the insurance carriers with apps and telematics-specific apps.

To find more in depth data analysis and information on this topic, please download the report, “US drivers’ appetite for new connected insurance propositions.”