How Connected Claims Enables Excellent Customer Service

Telematics gives insurers options to improve their claims strategy and enhance their policyholders’ experience

Smartphone telematics unlocks a number of claims services that allow insurers to offer their customers assistance and direction when they need it most. Because smartphone sensors can detect a vehicle impact and trigger an alert, this help begins before a driver can even file a claim. Empathetic service from initial impact through resolution increases competitive advantage and strengthens the insurer-policyholder relationship, ultimately improving customer acquisition and retention.

Promise of Help at Times of a Crash

A driver might be disoriented, stressed, or hurt following a crash, making it difficult to figure out who to call and what to do next. If the driver is unable to call for help themselves, their crash could go unnoticed, especially in more rural areas. Real-time impact alerts give the customer peace of mind knowing they’re protected at times of a crash.

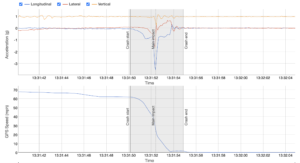

When sensors on the phone or a cordless IoT device detect a potential crash, a notice will be issued to a call center within a minute. That notice includes information like GPS coordinates, time of impact, and crash intensity, allowing insurers to make informed and immediate decisions on how best to proceed.

For less intense crashes that don’t suggest bodily injury, insurers can call their customer to confirm the crash and deploy the appropriate roadside services to the site. Arranging a tow truck is one less call that customers have to make, while receiving a proactive phone call from someone asking if they’re okay is a source of relief and assistance. For the more-severe impacts, emergency services can be automatically dispatched. The precise GPS location helps first responders find the crash site faster, saving valuable time.

Simpler Claims Filing via Proactive Outreach

Instead of focusing on their own safety after a crash, drivers have the burden of calling their insurer to file the claim. During the initial adjuster interview, it might be difficult for them to recall details of what happened. Insurers can alleviate this burden by making it easier for their customers to report a claim.

Telematics combined with artificial intelligence can report crash details that answer important questions minutes after the crash is detected. Not only are these details accurate, but they’re unique to the traditional eyewitness interviews and claim reports. After receiving this information, insurers can proactively reach out to their customers to start the claims process.

One option is calling to verify facts of loss like crash location, time, and the number of impacts on the insured vehicle. Instead of customers calling to explain, they’re calling to confirm. Insurers can also give their customers the option to kick-start a claim from their smartphone app. After a crash, customers will receive a push notification indicating the app detected an impact. In the app, customers can confirm the crash details and push them through to the insurer’s claims management system.

Faster and Improved Claims Resolution

An accurate and comprehensive summary of a crash early in the claims process ensures policyholders are paying the right amount as early

as possible. This is done by making the right decisions on the first go, such as channeling to the proper internal departments, sending the vehicle to the appropriate repair facility, and determining total loss with minimal labor resources. Timely resolution using unbiased and fair data lets policyholders move on faster, increasing customer satisfaction and confidence in the insurer’s services.

Contact us to learn how you can use Claims Studio to offer your policyholders valuable claims services.