Motor Insurance: Catalysts of Market Change

By Ryan McMahon

Originally published in Insurance Edge, 12/1/2020

It’s always fascinating to look at how technology has shaped business models. In “That Will Never Work” Marc Randolph, Netflix co-founder and it’s first CEO, describes how the creation of the DVD player enabled the company’s business model to flourish. If you remember, VHS tapes were bulky and cumbersome to ship, while DVDs were small and inexpensive to mail. That simple change was Netflix’s catalyst to create a completely new business model. The company’s explosive growth then came when it was able to get rid of the DVD entirely and base its offer on pure data.

Coming from a background in the insurance industry, I can see parallels to the examples above with many parts of the insurance industry’s value chain. Perhaps the most chronicled is the change in distribution where technology has enabled consumers to get quotes and buy online. However, I don’t think this is as dramatic as what is happening around us today.

The past 6 months have uncovered challenges few would have predicted, and fewer still could have prepared for. The succession of lockdowns and the constant variation in the confinement rules depending on location “tiers” have thrown out any remnants of routine.

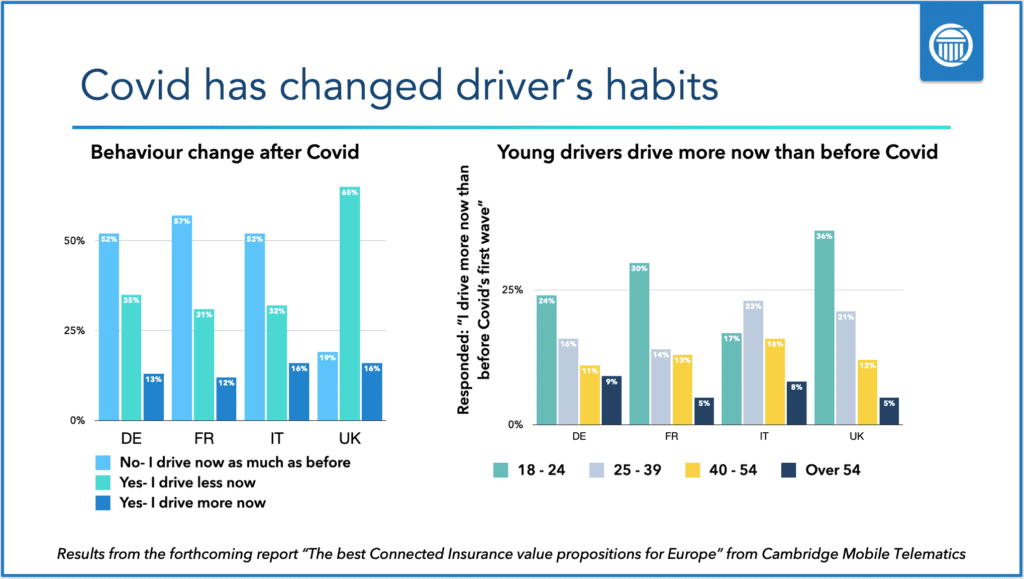

For the motor insurance industry, it first meant customers were not driving and claiming back their premium. Second, came the realisation that the ones who kept driving were the worst risk, leading to a spike in claims severity. Today, the old risk models for commuters are simply unusable; without individual driver data, insurers’ traditional risk proxies are no longer predictive.

Except, that is, for the insurers that were already providing connected insurance. These insurers are today able to identify precisely the risk of any of their drivers independently from their age, credit status or employment type.

Many of those are precursors with experience dating over 10 years of variously unsuccessful technology platforms. In earlier versions, the cost of the box (like the VHS tape) limited the product’s deployment to specific use cases.

The moment they switched to smartphone-centric connected insurance was their version of the moment Netflix first started streaming films on demand. That trigger was based on innovators like MIT professors Hari Balakrishnan and Sam Madden who saw the capabilities of the mobile phone well before the phone was capable of replacing either an OBD or a black box program. Together with Bill Powers, the three founded Cambridge Mobile Telematics based on that technology, and over time, the platform caught up and with cost shrinking, smartphone adoption soared.

This has ushered in a wave of new uses for the technology including try before you buy offers, rewards programs, continuous engagement but also support existing behaviour and/or mileage-based programs more sustainably. At the same time, the new technology has enabled actuaries to identify new risk factors such as driver distraction and apply individual scoring to all age groups.

It really is a renaissance for the industry that has not fully been realized yet as insurers can use the product to tackle more issues and actually improve their loss experience. This itself is a bit amazing, when you think about it. The insurance industry in general has always invested in loss control and engineering for exceptionally high hazard business, but never on such a large scale for motor.

As the technology matures, the industry is becoming more creative and deploying new value propositions. In turn, it is expanding the total amount of data collected as the segments that an insurer targets have grown much further beyond the initial scope of the business for a score based on a handful of trips. Further, insurers have moved to expand who they offer these programs to, including their existing policyholders.

As these factors have come together, the corpus of data collected today is very different from that of the niche segments from the old telematics programs, which means companies that have continued to invest in these offerings now have a massive competitive advantage they can execute on. Connected insurers now have the ability to put more emphasis on personalized risk data which means that the price a driver pays for insurance is based on factors they control. It is also much more flexible and able to adapt to situations like the pandemic we are experiencing.

With all cases of technology change, without a strong consumer pull, the product will never flourish. Had consumers never bought DVD players, Netflix would have never survived long enough to grow into the company we know today. In terms of connected insurance, the growth is driven by the insurers themselves. Their innovations and investment have resulted in higher competitiveness, much better loss ratios and the ability to retain customers longer.

For many in the insurance industry, their strongest memory of telematics is generated from the “VHS period” when it was clunky, hard to use and expensive. This is especially true for many agents who over time were unfortunately in the position to drive this product forward at a time where the consumer value proposition was held back by the technology. Today, however, the use cases being innovated by insurers across the globe are giving more value to consumers. The biggest challenge now is helping to spread the word that there are great new products on the market that don’t require a trip to Blockbuster.