Will 2021 be the Year of Connected Claims?

In January and September 2020, CMT conducted a survey with drivers in four countries in Europe. The answers from French, German, Italian ,and British drivers gave us a unique understanding on how the COVID-19 lockdowns are impacting people’s driving choices and preferences. For instance, the survey showed how driving patterns have changed as well as an increased interest in Connected Insurance products.

Part of the questionnaire focused on their experience when filling a claim and what channel they would prefer to use in the future. It showed the demand for claims assistance services in Europe is very high and rising with different patterns between countries. In the U.K. and Germany, it has more than doubled since the onset of COVID.

Experience with claims varied between countries: 26% of Germany found the process very easy while in other countries 15% complained of having had real difficulties.

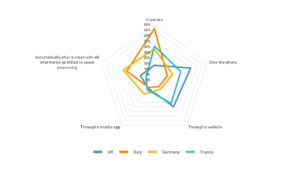

In terms of claims filing, each country was shown to have their own preference. Italian drivers prefer to submit a claim directly with their broker. British drivers clearly favored the phone. French drivers were split between using a website and claiming in person. German drivers were partial to different channels of communication but many wished the claim process could be dealt automatically after the crash.

The technology behind telematics-based connected claims has been discussed for many years, but now drivers are beginning to expect their insurers to provide it. For example, claims assistance using automatically generated reports came close second from a pool of 16 services to choose from.

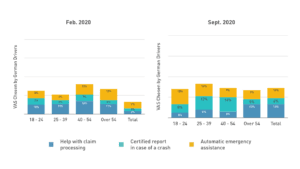

Germany’s Demand for Claims Related Services Before & After COVID-19 First Wave Lockdowns

In Germany, the overall demand for claims services has increased by 123% after the initial lockdowns. All ages are demanding the services more or less equally, but emergency assistance is particularly appreciated by the older generation.

Looking at the newer generations, drivers in Germany (36%) and Italy (39%) are the most excited by an automated claims process after a crash that enables all information to be pre-filled to speed processing.

How Younger Drivers Prefer to File a Claim

What remains to be seen is how that automated process can convert the majority of drivers that prefer to talk to their insurer or agent. It is clear that claims management will be expected to remain a sensitive experience that will continue to require empathy.

If you are interested in finding out how insurers worldwide have managed to include automation and efficiencies in the claims process while increasing their level of customer service, download the full report here.