Idaho Becomes 49th State to Approve Cambridge Mobile Telematics’ Premium Scoring Model

Idaho insurance commissioners approve life-saving telematics technology for both for personal and commercial lines

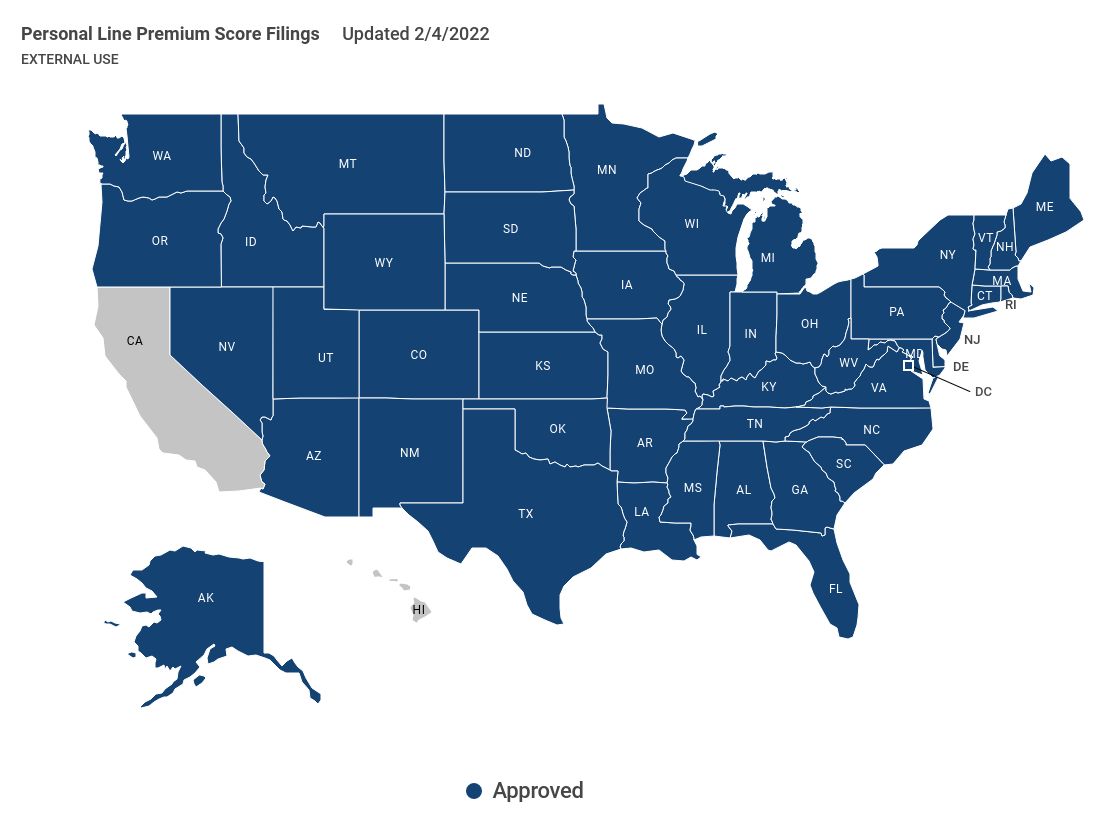

CAMBRIDGE, Mass. Cambridge Mobile Telematics (CMT), the global leader in mobile telematics, announced its behavior-based premium insurance scoring model has just been approved in Idaho for both personal and commercial lines. CMT now has both personal and commercial lines scoring models approved in 49 U.S. states including Washington D.C.

CMT’s solution assesses crash risk based on an individual’s behavior behind the wheel. The telematics-based offering uses highly predictive factors like speeding, hard braking, and phone distraction (both tapping and phone motion) for an unbiased and accurate picture of crash risk. This enables insurers to offer auto insurance to a consumer based on their driving behavior.

With these approvals, CMT’s insurer partners writing business in Idaho can now file with the Idaho Department of Insurance to build telematics products on the leading mobile telematics platform in the world.

“With this approval in Idaho for both commercial and personal lines, CMT’s market-leading technology and Premium Score is now available in 49 states,” says Ryan McMahon, VP of Strategy at CMT. “Drivers will now be able to receive a personalized auto insurance rate based on how they drive, which is the most transparent way to price auto insurance.”

CMT’s data scientists and actuaries derive telematics data from millions of drivers covering billions of miles. CMT’s research shows that drivers who regularly engage with a telematics-based insurance app improve their driving behavior and are less likely to switch insurance programs.

About CMT

Cambridge Mobile Telematics (CMT) is the pioneer of mobile telematics. Its mission is to make the world’s roads and drivers safer. The company’s AI-driven platform gathers sensor data from millions of IoT devices — including smartphones, Tags, connected vehicles, dashcams, and third-party devices — and fuses them together with contextual data to create a unified view of vehicle and driver behavior. Companies from the personal and commercial auto insurance, automotive, rideshare mobility, personal safety, wireless carriers, auto retail, and financial services industries use insights from CMT’s platform to power their risk assessment, safety, claims, and driver improvement programs. Headquartered in Cambridge, Mass, with offices in Budapest, Chennai, Seattle, and Tokyo, CMT serves millions of people daily through 80 programs in 20 countries, including 21 of the top 25 US auto insurers. For more information, visit CMT.ai.