What do drivers think about telematics?

Telematics is no longer an industry buzzword. Every top auto insurer has had a telematics program for years. These programs have evolved beyond usage-based insurance to include life-saving crash assistance, rewards, and more.

They’re also growing in popularity. Insurers are offering telematics programs more often, with some reporting take rates above 50%. From 2020 to 2023, CMT saw a whopping 142% increase in telematics adoption across its platform.

There’s no question about whether telematics programs work. They’re proven to reduce driving risk.

But what do drivers think about telematics programs?

Over 1,100 drivers in 2023 and 1,350 in 2024 shared their thoughts. In the video above, you can hear what some of them are saying about telematics programs. For the surveys, respondents shared everything from their experiences with UBI programs, their savings, to shopping and digital habits. Here’s what they said.

Growing awareness and approval

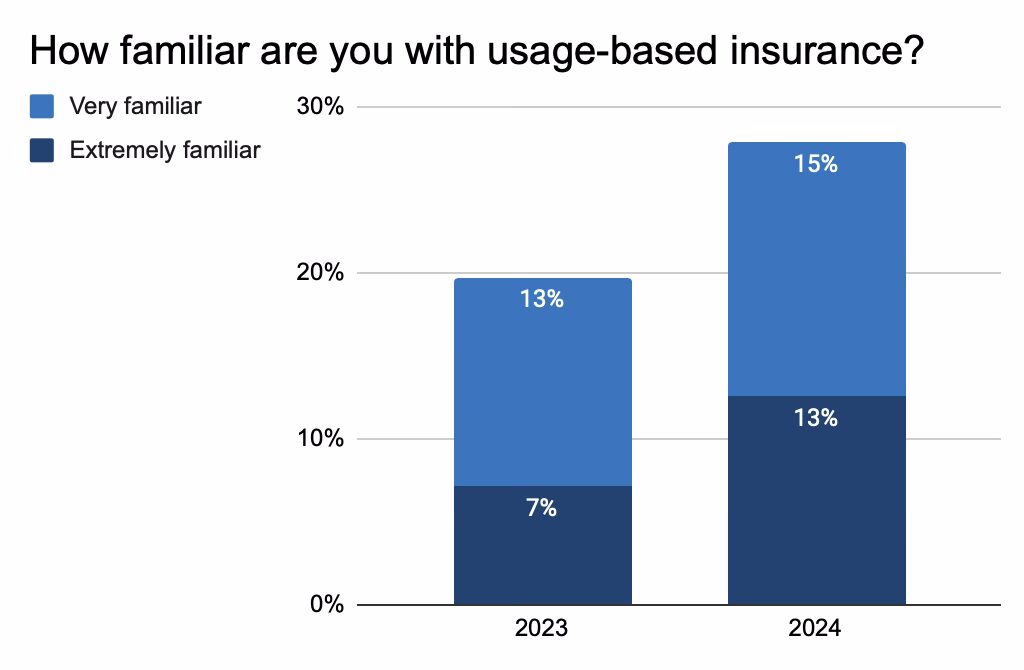

From 2023 to 2024, consumer awareness and approval rose. In 2024, 28% of drivers said they were very familiar or extremely familiar with UBI programs — a 41% increase from 2023. More consumers also viewed UBI favorably, with the number reaching 87% in 2024, up from 86% in 2023.

Savings drive adoption

With rising premiums and claims inflation, consumers have been thinking more about saving money on auto insurance. In 2024, 38% of consumers looked for insurance savings in the prior 3-6 months, a 23% increase over 2023.

The search for savings also became even more frequent. Twenty percent of drivers searched for savings in the prior 3 months in 2024 compared to 14% in 2023, a 42% jump.

Consumers want savings

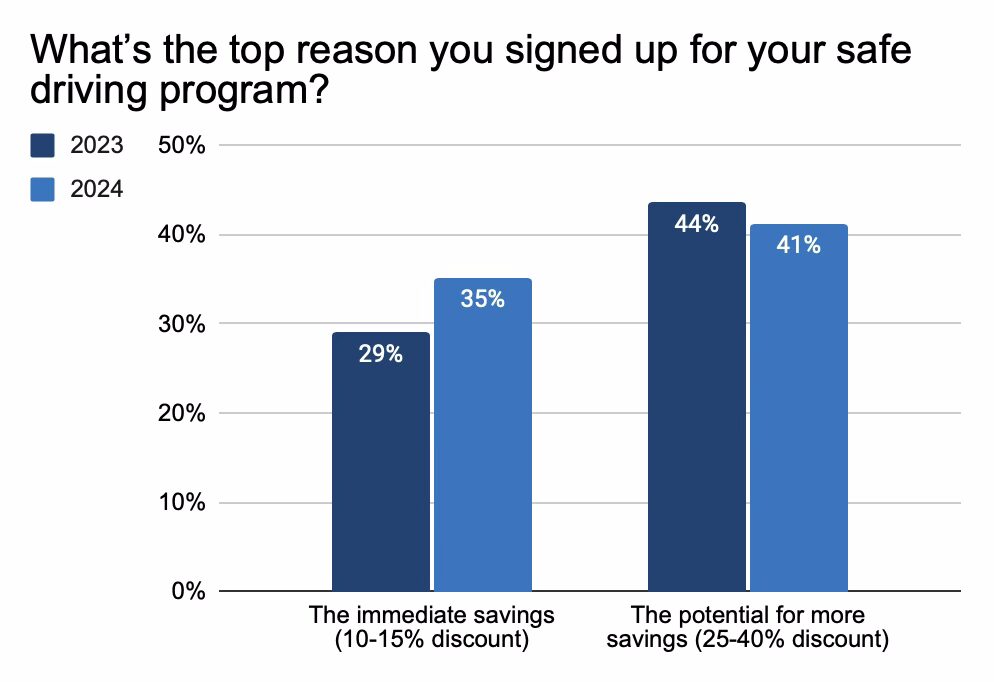

Over 600 of the survey respondents said they were in a usage-based insurance program today. Seventy-six percent of them said savings was the top motivation for enrolling in a UBI program in 2024, up from 73% in 2023. Overall, getting a big discount was the top reason for 41% of respondents in 2024. However, drivers started caring more about immediate savings in the past year. In 2024, 35% of people said they signed up for a UBI program for the immediate savings, up from 29% in 2023.

Consumers are seeing the positive impact on their wallets. In 2024, 99% of UBI respondents said they had saved money or broke even with their safe driving program. Seventy-seven percent of them said they saved at least $100 on their insurance. 21% of consumers said they saved over $300, a 26% increase over 2023.

As consumers see the savings, they become more loyal to their carrier. In 2024, 93% of drivers reported feeling more positively about their insurer after joining a safe driving program. Forty-three percent of UBI respondents said they’d “definitely” stay with their insurer, up from 32% in 2023.

The result? More consumers are safe driving program advocates. Ninety-three percent of consumers said they’d recommend their program to their friends and family. Word of mouth is a powerful motivator for purchasing decisions, so this is great news for more telematics growth in 2025.

The more consumers hear about digital offerings and become more digital themselves, telematics programs will become even more attractive. Consumers’ digital fingerprints grew in 2024, with 47% of people making a purchase with an app in the prior week, a 9% rise. Consumers also prefer filing insurance claims digitally now.

Consumers think it’s fair

Consumers have also developed a stronger opinion about setting insurance rates based on how safe you drive. Overall, 92% of US consumers agree that every US driver’s premium should be based on how safe they drive. Those who strongly agree reached 49% in 2024, up 18% since 2023.